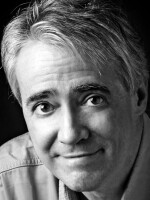

SCOTT SIMON, HOST:

More Americans love to shop and are shopping a lot. But big chain stores are said to be anxious about the year ahead, according to a flurry of recent financial reports from large retailers. NPR retail correspondent Alina Selyukh has read them all. What fun. She joins us now. Thanks for being with us, Alina.

ALINA SELYUKH, BYLINE: It really was. It really was.

SIMON: So why are food and retail giants - I'll put it this way - fretful?

SELYUKH: About this coming year? Sure. They - and here I just want to clarify. We're talking about stores you really know like Walmart, Target, Wendy's. And they kept talking about everyone's favorite word, uncertainty - or to quote Walmart's CEO, "the unknown unknowns." We kind of know what they are - inflation, the Federal Reserve's plan for interest rates, slowdown in the housing market, growing household debt. Who knows what happens with the supply chain, the war in Ukraine? And that's how you get these superanxious forecasts even when customers are spending a lot. Like, Target is saying, sales may grow, or maybe they won't. Or McDonald's CEO is saying, shoppers are doing a ton better than we could have predicted even six months ago, but then, maybe we'll face a mild to moderate recession this year.

SIMON: Could they be hedging their bets, which, I guess, first just might be sagacious, but also just so their investors don't get riled?

SELYUKH: Just sort of set the bar low? I actually posed this question to Arun Sundaram, who tracks retail and food companies at equity research firm CFRA. He said that's probably part of it.

ARUN SUNDARAM: Certainly, the retailers like to set the bar low and then come in and exceed those expectations. But I think the other part is, really, the uncertainty on the macro environment. You know, inflation has been stubbornly high. We don't know what the Federal Reserve is going to do. There's a lot of debate on that right now.

SELYUKH: You heard it again - uncertainty. Plus, shoppers are still changing how they spend. Home Depot had a rough end of the year and blamed part of it on the fact that people are dedicating more of their budgets to activities and trips instead of things. Store brands are having a big moment, people shopping for these cheaper private brands instead of the big national brands. That includes higher-income shoppers, who are also increasingly turning up in Walmart's grocery aisles or at Wendy's instead of maybe some pricier restaurant. Dollar Tree's CEO specifically called out shoppers earning over $80,000 a year as trading down and coming to dollar stores.

SIMON: Of course, the dollar stores, every store, has been raising prices, too. That must be having an impact, isn't it?

SELYUKH: With groceries and food, I just want to say, that doesn't seem to be the case yet. People seem to be still paying higher prices for food. Wendy's executives, for example, said they haven't seen any visible pushback to their price increases.

SIMON: What about beyond food and groceries?

SELYUKH: Yes, very much so because shoppers are kind of having to decide whether to pay that 20 bucks on eggs and milk or to buy a - I don't know - a random shirt they don't really need - not a necessity. One big outlier on this is beauty. People apparently are splurging on makeup, skincare, perfumes. And so, for example, Target and Kohl's said sales at the beauty counter are helping offset losses maybe in other departments. But overall, clothing, home improvement stores, other stores that don't sell essentials are feeling the pain to various degrees. Best Buy, for one, gave one of the most dire forecasts for the year, predicting it will be the worst year yet for sales of consumer electronics.

SIMON: NPR retail correspondent Alina Selyukh, thanks so much.

SELYUKH: Thank you.

(SOUNDBITE OF MUSIC) Transcript provided by NPR, Copyright NPR.